Brazil's domestic prices fall with on hold demand and great supply

Prices in Brazil's domestic soybean spot market have been on a sharp downward trend in 2024, as the market regulates an environment of lukewarm demand and ever greater supply.

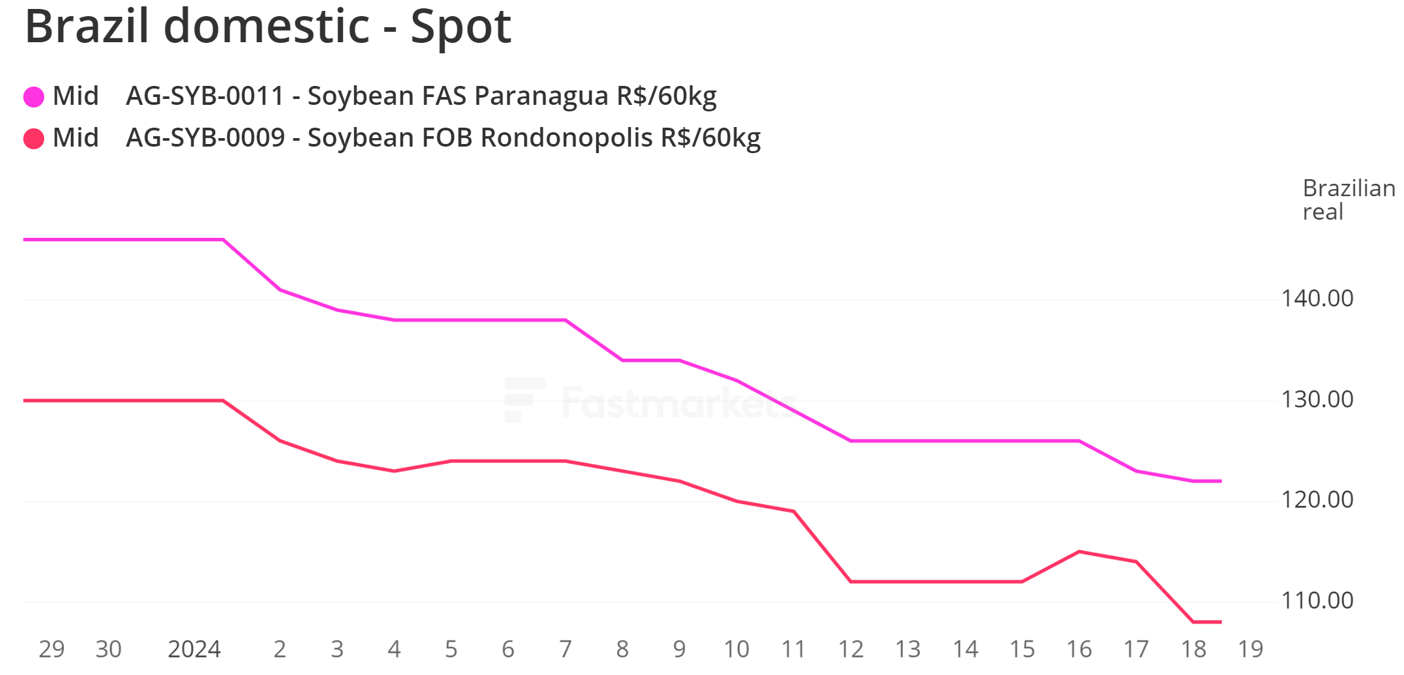

Brazil’s FAS Paranaguá price fell from BRL147/bag ($496.95/mt) on January 2 to stand at BRL122/bag ($412.44/mt) on Thursday - a 17% decline.

In the biggest producing state, Mato Grosso, the spot price based in Rondonópolis fell from BRL126/bag ($425.96/mt) to BRL108/bag ($365.11/mt) during the same period, where trade was done at the same price.

That decline has come despite mounting worries over the state of the crop, with yield losses reported in the state due to drought and leading to the Mato Grosso’s Economy and Agriculture Institute (IMEA) to expect 39 million mt to be harvested according to a report released on Monday.

That represents a 10.9% reduction compared to the initial estimate of 43.8 million mt, and would be 13.9% lower than the 45.3 million mt collected last year, according to the same database.

Part of the explanation can be found in Brazil’s export prices, as international demand is responsible for the biggest share of the country’s soybean destination, taking 65.8% of last season’s total supply, according to Brazil’s Supply Company (Conab).

FOB Paranaguá outright prices on February loading were assessed at $415.95/mt as of Thursday, again in sharp contrast to $466/mt on January 2, as the Chinese demand – Brazil’s main export destination – remains lukewarm.

“China’s demand is shy, working with its ‘wait and see’ tactic, holding their buying intentions while Brazil’s prices fall,” said Aldo Lobo, a broker at Origem.

“China’s demand is virtually on hold, as the hog market in the country is not strong either,” Gilberto Leal, Granel Brokerage’s risk manager told Fastmarkets.

Even Brazil’s crush industry is not very active on the moment, as “crush margins are bad, very different from the same point last year.”, Eduardo Vanin, Agrinvest’s market analyst said.

That happens at the same time as Brazil’s farmers are trying to hold their selling while wait for better prices.

On the supply side, Brazil’s overall crop estimate has been reduced as the center-west region faced a drought late last year, at the same time as the south was registering excessive rain and a lack of sun.

Conab expects the country to produce 155.2 million mt in the 2023/24 campaign, 4.1% lower than the initial estimate of 162 million mt, but still higher than the 154.6 million mt from the 2022/23 crop.

However, expanding the scope to South America, overall supply is expected to be considerably higher than last year, as the US Department of Agriculture reflected in its World Agricultural Supply and Demand Estimates (Wasde) report last week.

Production in Brazil, Argentina and Paraguay – the biggest exporters – is forecast at 157 million mt, 50 million mt and 10.3 million mt respectively, leading to an output of 220.2 million mt.

That's nearly 13% higher than the 195 million mt from last year, as shown in January’s Wasde update.

“If you take the latest crops South America offer data, you’ll see that Brazil has to harvest less than 130 million mt to have the same offer volume as last year with Argentina’s recovery”, João Bassetto, Granopar’s market analyst told Fastmarkets.