Latest News

The German 12.5% FOB wheat APM basis assessment for June loading was assessed unchanged at a €2 per tonne premium to the September Euronext wheat contract...

The soybean CFR China (Brazil) basis assessment for June loading was assessed unchanged...

US wheat futures continued to move lower across all three classes on Wednesday May 1 due to a rising US dollar and needed rain that is forecast across growing areas in the US, Canada and Russia.

Freight rates eased in the week to Wednesday May 1 with weaker demand in the Asia-Pacific region and an improving outlook for the Panama Canal weighing on rates.

US corn futures moved into positive territory on Wednesday May 1 due to higher weekly ethanol production and consumption.

Soybean futures on the Chicago Mercantile Exchange (CME) were higher on Wednesday May 1 amid a softer tone in the macro markets, with traders expecting the US Federal Reserve to keep interest rates unchanged. The limited participation from many European markets, which were on holiday, might have curtailed activity.

Algeria’s state-backed grain importing agency, OAIC, is expected to close a tender to buy a nominal 50,000 tonnes of wheat on Thursday May 2, trade sources told Fastmarkets on Wednesday May 1.

US weekly ethanol production increased by 33,000 barrels per day to 987,000 barrels per day in the week ended April 26, according to data published by the US Energy Information Administration (EIA) on Wednesday May 1.

China’s soybean crush volume in the week ending Friday April 26 ended its upward trend and edged down by 30,000 tonnes, or 1.54%, to 1.92 million tonnes compared with the week to April 19, according to data from the China National Grain and Oil Information Centre (CNGOIC).

The Argentine Oilseed Crushers Union (SOEA) announced on Tuesday April 30 the end of the strike that had started on Monday, according to a union note.

Second corn crop conditions worsened in the Brazilian state of Paraná, while the soybean harvest was completed and wheat sowing was favored by the weather...

Brazil’s grain exporters association Anec increased its soybean export estimates for April, while lowering projections for soymeal, corn and wheat exports...

Soyoil futures in Chicago fell steeply to multi-year lows on Tuesday April 30, pressured by multiple factors, with palm oil futures also losing ground in Asia.

Soybean futures on the Chicago Mercantile Exchange (CME) were considerably lower on Tuesday April 30 in a perfect storm caused by full-steam US sowing progress and derived and external markets.

US wheat futures moved down across all three classes based on planting progress that landed above expectations and a higher US dollar limiting buying power.

US corn futures continued lower on Tuesday April 30 on good planting progress reported late on Monday April 29.

Indonesia’s palm oil inventories totaled 3.26 million tonnes at the end of February, up by 7.49% from January, following a decrease in exports and domestic consumption, according to data from the Indonesian Palm Oil Association (Gapki) released on Tuesday April 30.

The soybean CFR China (Brazil) basis assessment for June loading was assessed 5 c/bu lower...

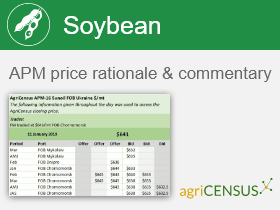

Fastmarkets Agricensus commits to publishing on a daily basis the bids, offers, indicative levels or other cash trading indications on any basis and geography that relates to any of the vital markets that have strong ties with Ukraine.

The German 12.5% FOB wheat APM basis assessment for June loading was assessed unchanged at a €2 per tonne premium to the September Euronext wheat contract...