Latest News

US wheat futures edged higher on Wednesday October 9, with traders taking cues from technical signals and speculation that the USDA’s influential World Agricultural Supply and Demand Estimates (WASDE) report will show lower forecasts for global and domestic ending stocks.

Vegoils futures trended mostly lower across markets and regions on Wednesday October 9, while crude oil prices continued to decline under risk-off positioning, Fastmarkets heard.

Dry bulk freight rates for Panamax vessels in the Atlantic picked up in the week to Wednesday October 9 amid volatile crude oil prices and limited tonnage availability.

US corn futures were little changed on Wednesday October 9 as traders awaited the USDA’s influential World Agricultural Supply and Demand Estimates (WASDE) report, which is projected to bring lower forecasts for domestic corn production and domestic ending stocks.

Fastmarkets commits to publishing on a daily basis the bids, offers, indicative levels or other cash trading indications on any basis and geography that relates to any of the vital markets that have strong ties with Ukraine.

Euronext's commitment of traders report in the week to October 4 showed the net short position in wheat futures contracted by 45% as investors continued to shift their positioning, reducing short positions and adding to long positions – leading to a net short position of 60,618 lots.

The German 12.5% FOB wheat APM for November loading was assessed at a €8 per tonne premium over the December Euronext contract

US weekly ethanol production increased by 23,000 barrels per day to 1.038 million bpd in the week ended Friday October 4, according to data published by the US Energy Information Administration (EIA) on Wednesday October 9.

The USDA is expected to cut its US soybean production and yield estimates for the 2024/25 year and increase its forecast for ending stocks in its World Agricultural Supply and Demand Estimates (WASDE) report to be published on Friday October 11, a Fastmarkets poll of 10 traders and analysts showed on Wednesday October 9.

The USDA’s influential World Agricultural Supply and Demand Estimates (WASDE) report for October is projected to reduce estimates for both domestic and global 2024/25 crop ending stocks, according to analysts polled by Fastmarkets.

Algeria’s state-backed grain importing agency OAIC purchased an estimated 630,000 tonnes of milling wheat for October delivery, market participants told Fastmarkets.

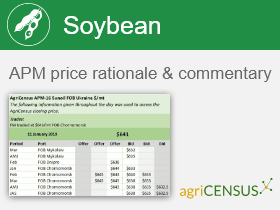

The soybean CFR China (Brazil) basis assessment for November shipment was assessed

Algeria’s state-backed grain import agency Inter-professional Office of Cereals (OAIC) has purchased up to 480,000 tonnes of milling wheat, likely to be sourced from the Black Sea, in a tender that closed on Wednesday October 9.

Freight rates for vessels carrying palm oil cargoes within Asia held steady in the week to Wednesday October 9, as palm inquiries for October improved, with still healthy tonnage available.

Tunisia’s state importer has picked up 125,000 tonnes of optional origin barley in its tender closed on Tuesday October 8, paying $234.84 per tonne CFR on average, sources told Fastmarkets.

Market participants polled by Fastmarkets ahead of the USDA’s October World Agricultural Supply and Demand Estimates (WASDE) report update on Friday October 11 project that the agency will lower new and old crop ending stocks estimates, as well as lower 2024/25 production.

Brazil’s 2024/25 soybean sowing has reached 5.1% of the projected area of 47.4 million hectares and remains behind the 10.1% completion rate from a year earlier, the country’s food agency Conab said. Sowing is delayed in Mato Grosso and at a faster year-over-year pace in Paraná.

Soybean futures dropped double digits on the Chicago Mercantile Exchange on Tuesday October 8 amid the fast pace of harvest in the US and forecasts of rain for South America, with pressure from the sharp decline in crude oil.

A sharp decline in crude oil prices linked to easing tensions in the Middle East and profit-taking weighed on Malaysian crude palm oil (CPO) and Chicago soyoil markets on Tuesday October 8, with the latter falling steeply on the day.

Global wheat futures rose on Tuesday October 8 amid concerns about dry conditions in Russian growing regions, as well as tensions in the Black Sea and a flurry of buying activity.