Latest News

Crude palm oil (CPO) futures surged on Tuesday July 2 to the highest price in nearly 12 weeks and extended gains for the fifth straight session, tracking strength from the wider vegoils complex and finding further support on a tighter supply outlook and an active cash market.

The start of the Black Sea region’s new wheat marketing year from Monday July 1 offers an opportunity to look back on the previous marketing year and to focus on Ukraine’s experience and the effect that the self-declared humanitarian corridor has had on the country’s agricultural exports.

Soybean futures were broadly unchanged on Tuesday July 2 amid underlying support from rising soyoil prices and favorable weather prospects in the US.

US and European wheat prices retreated on Tuesday July 2 while the harvest of the US winter wheat crop accelerated, helping spur profit-taking.

US corn futures nearby contracts trended higher into green territory on Tuesday July 2 following lower weekly crop ratings reported by the USDA late on Monday July 1, which were below market expectations.

The USDA attaché in Brazil reduced its estimates for the country’s 2023/24 soybean output due to floods in the South and yield losses in other states, while raising its projections for 2024/25.

Fastmarkets commits to publishing on a daily basis the bids, offers, indicative levels or other cash trading indications on any basis and geography that relates to any of the vital markets that have strong ties with Ukraine.

Sentiment among US agricultural producers slipped slightly in June, with the Index of Future Expectations responsible for the decline, the Purdue University/CME Group Ag Economy Barometer survey showed on Tuesday July 2.

The soybean CFR China (Brazil) basis assessment for August loading was assessed 4 cents per bushel lower...

The German 12.5% FOB wheat APM basis assessment for August loading was assessed unchanged at a €6 per tonne discount to the December Euronext wheat contract...

South Korean feed importer Feed Leaders Committee (FLC) has purchased around 65,000 tonnes of corn for arrival around November 15 via a tender that concluded on Tuesday July 2, sources told Fastmarkets.

Japan's Ministry of Agriculture has issued an international tender for the purchase of 129,660 tonnes of wheat from the US, Canada and Australia for loading in September-October, an official note published by the ministry showed on Tuesday June 2.

US growing crop conditions were mixed in the week to Sunday June 30, with corn, winter wheat and barley ratings declining week on week, the USDA’s weekly crop progress report showed on Monday July 1.

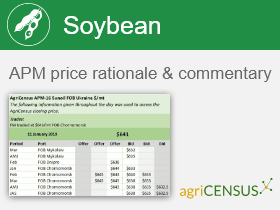

After a consultation period, Fastmarkets has amended the pricing methodology of for several soybean price assessments to better reflect quality specifications, payment terms and delivery periods used in the market.

Corn consumed for alcohol and other uses in the US totaled 508 million bushels (12.9 million tonnes) in May, up 8% from the previous month and 3% higher year on year, according to the USDA's monthly Grain Crushings and Co-Products Production report released on Monday July 1.

In the Americas, soyoil futures surged on Monday July 1 amid a short squeeze with managed money investors pressured to get off a large holding of net short positions.

Soybean futures rebounded on Monday July 1, with a bias to the front end of the curve borrowing strength from surging soyoil prices.

US and European wheat prices trended upward on Monday July 1 amid reports that areas of Russia and Ukraine were once again dry.

On Monday July 1, US corn futures extended losses from Friday June 28 following bearish USDA reports, which revealed higher-than-expected corn acres and quarterly stocks.

Fastmarkets commits to publishing on a daily basis the bids, offers, indicative levels or other cash trading indications on any basis and geography that relates to any of the vital markets that have strong ties with Ukraine.