Latest News

US corn futures dropped for a sixth consecutive trading day on Wednesday June 26 while rain continued to fall in growing areas of the Midwest, with market participants positioning before a USDA acreage report to be released on Friday.

US and European wheat prices rebounded from two-month lows on Wednesday June 26 on forecasts for drier weather in important Russian grain-growing regions and after failing to break through technical support this week.

The completion of the sowing campaign across the Black Sea countries of Ukraine, Turkey, Romania, Bulgaria and Russia means that expectations for the region’s total production can now be refined into more tangible forecasts against a backdrop of a year-on-year increase of 4% in planted area and an anticipated improvement in yields.

Dry bulk freight rates for Panamax-sized vessels fell in the week to Wednesday June 26 after several weeks of rises, with increased tonnages and seasonal slowdowns being outweighed by the demand for grains.

Fastmarkets commits to publishing on a daily basis the bids, offers, indicative levels and other cash trading indications on any basis and geography that relate to any of the vital markets that have strong ties with Ukraine.

The German 12.5% FOB wheat APM basis assessment for August loading was assessed unchanged at a €6 per tonne discount to the December Euronext wheat contract...

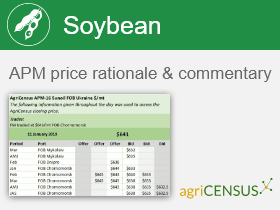

The soybean CFR China (Brazil) basis assessment for August loading was assessed 3 c/bu higher at a premium of 182 cents per bushel to the August CME soybean futures contract...

Euronext's commitment of traders report in the week to Friday June 21 showed a rise in short positions, while long positions in wheat futures contracted, leading to a decrease in the contract’s net-long position.

US weekly ethanol production decreased by 14,000 barrels per day to 1.04 million bpd in the week ended Friday June 21...

South Korean feed importers Major Feedmills Group (MFG) and Feed Leaders Committee (FLC) have purchased a total of 200,000 tonnes of corn for November arrival on Wednesday June 26, sources told Fastmarkets.

Freight rates for vessels carrying palm oil cargoes from Southeast Asia to key destination markets were unchanged in the week to Wednesday June 26, with healthy sentiment regarding June and early July shipments.

Iran's state importer booked three cargoes of 65,000 tonnes of soybean meal each in an international tender, sources told Fastmarkets on Wednesday June 26.

China’s soybean crush volume rose by 40,000 tonnes to 1.94 million tonnes in the week to June 21 compared with the previous week, according to the most recent data released by the China National Grain and Oil Information Centre (CNGOIC).

Malaysia’s palm oil exports during June 1-25 fell by 17.9% month on month to 845,359 tonnes, data from cargo surveyors Intertek Testing Services (ITS) released on Tuesday June 25 showed.

The second corn crop harvest in the Brazilian state of Paraná reached 42% of the 2.4 million-hectare sowed area, an advance of 13 percentage points, in the week to Monday June 24, state agency Deral’s weekly report showed on Tuesday June 25.

Brazil’s grain exporters association Anec reduced its June soybean export forecast to 14.5 million tonnes from the previous estimate of 14.8 million tonnes, but the projection remains a record for the month despite the reduction, the association said in its latest report released on Tuesday June 25.

Crude palm oil (CPO) futures in Malaysia traded lower on Tuesday June 25 under pressure from weaker related vegoils and a soft export pace.

Soybean futures tumbled and erased Monday’s gains on Tuesday June 25 amid downward pressure from falling prices of downstream products and improved weather conditions in the US.

Egypt’s state-backed General Authority of Supply Commodities (GASC) has secured 470,000 tonnes of wheat from Russia, Ukraine, Romania and Bulgaria for August and September shipment, after successfully closing a tender on Tuesday June 25.

The German 12.5% FOB wheat APM basis assessment for August loading was assessed unchanged at a €6 per tonne discount to the December Euronext wheat contract...